Real World Data on House Price Impact of Climate Risks

The earliest paper we found examining the impact of climate risks on house prices was from 2017, which found a relationship between elevation/sea level rise and house price differences.[1]

We built our climate-conditioned HPA model in 2022 based on the idea that an increase in insurance costs would impact house prices (something we had not studied yet) in the same way that an increase of the same size in mortgage rates would impact house prices (something that we were quite familiar with).

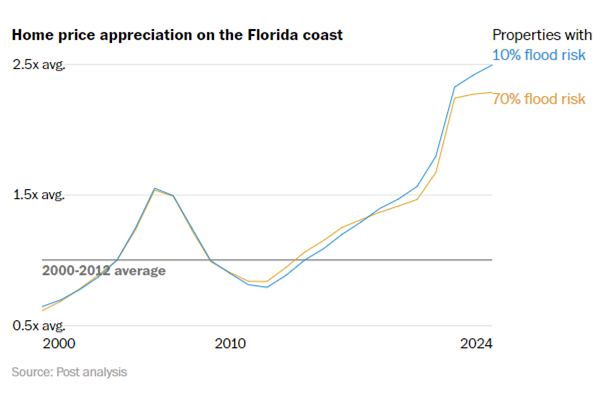

The real world evidence for this relationship has been accumulating recently – on October 15, 2024 the Washington Post published an article entitled “Where climate change poses the most and least risk to American homeowners” which contains the following chart (which is based on an analysis of 2 million home sales in Florida since 2000):

We can see from the lines comparing lower and higher flood risk properties that until very recently, the housing market was not pricing for flood risk. But now there is a clear divergence in price trend.

For the particular case of Florida, there is reason to believe that this trend will strengthen in the near term: until recently, the only reason most people got flood insurance was that they were in a FEMA flood zone and they were required to buy a NFIP policy in order to obtain a mortgage. FEMA flood zone maps are known to be extremely outdated. However, with the accumulation of flooding incidents occurring outside those zones and the publishing of flood risk scores on Zillow, buyers are becoming much more aware of flood risk whether or not a property is in a FEMA zone.

Additionally, the state of Florida is gradually requiring all homeowners buying insurance through Citizens (its FAIR plan for homeowner’s insurance) to also have flood insurance regardless of flood zone status. This requirement started in 2024 for houses priced $600,000 and above, and by January 1, 2027, will extend to all properties insured by Citizens. At the end of 2023, Citizens was the largest insurer in Florida with 15% of all policies and over half a trillion dollars of insured properties.

Furthermore, the different post-event experiences of homeowners who have flood insurance versus those who didn’t is likely to encourage more homeowners – even those not taking a policy through Citizens – to add flood insurance to their property. So flood risk, at least in Florida, is getting closer to being fully priced into real estate values.

While the Washington Post article only discusses flood risk, all borrower costs matter to housing affordability – property taxes, homeowner’s and flood insurance, and the mortgage (leaving aside the psychological costs of nuisance events that don’t rise to the level of filing a claim). To truly capture the potential impact on both house prices and borrower behavior of all these rising costs, a fully climate conditioned approach, combining home prices as well as borrower behavior models (how will prepayment, delinquency, default and loss severity be affected?) is required. This is what our Climate Impact Suite offers.